“Crypto Safe Hai!“

“Kya aapke portfolio mein crypto hai?“

“Safe hai, simple hai”.

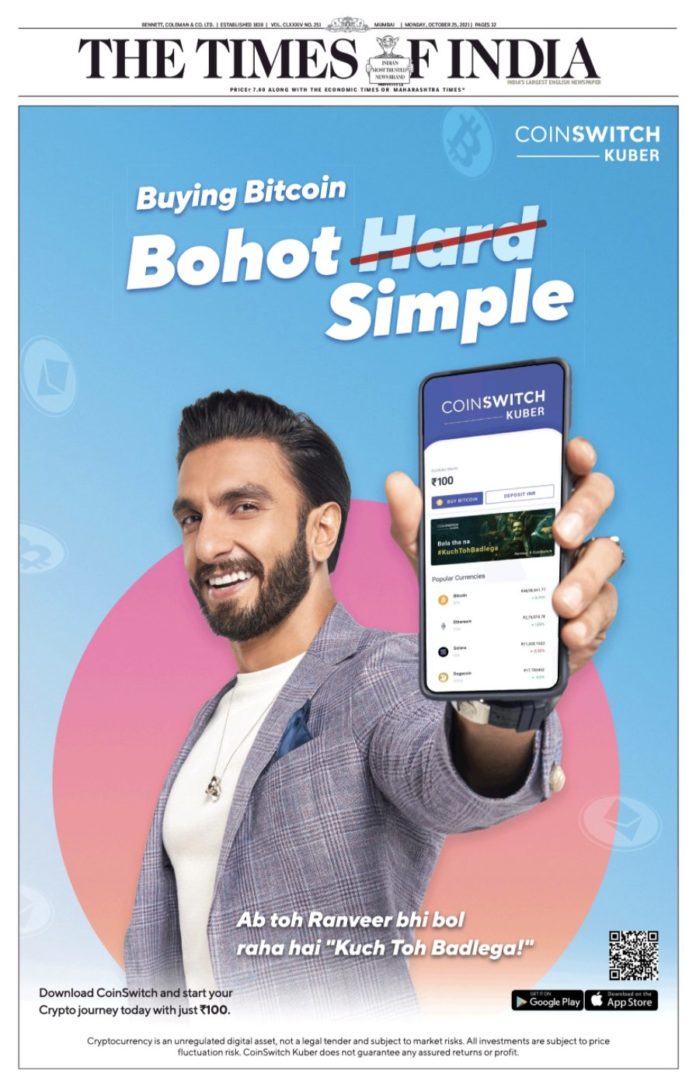

If you are living in India these days, you might have definitely come across these lines unless you are living under a rock. These are the tag lines from crypto ads that have exploded in recent times from television to print to the digital medium. The ads position crypto as a safe investment option and try to create FOMO.

But wait, cryptocurrency is in a grey area in the country. There are no laws that regulate the actions of crypto exchanges. Referring to an unregulated area as a safe investment option is far from true.

Only a few days back, a coin banking on the popular Korean Netflix show “Squid Game” carrying the same name hit an all-time high of $2860 only to fall to near zero in a matter of minutes wiping millions of dollars in investors wealth but benefiting the people behind the project.

The unregulated market means no safeguards for investors against fraud or market volatility. Take the matter of mutual funds – an investment product heavily regulated by SEBI. The ads by mutual funds association (AMFI) with the tagline “mutual funds sahi hai” carry a disclaimer directing users to prior research and warning them of market volatility. Definitely, crypto is not a safer option than mutual funds for a retail investor – at least at this point in time.

The industry has recently adopted a self-regulatory code under the aegis of IAMAI. Top crypto exchanges are proactive in identifying and banning accounts that may be associated with fraud or malicious activities. But self-regulatory activities cannot be equated to statutory regulations – especially when it is in the interest of retail investors who may have their life savings at stake.

Crypto Regulations – Where are we?

In April 2018, the country’s central bank (RBI) had directed banks and other regulated financial entities against dealing with clients who handle cryptocurrencies such as bitcoin, effectively banning crypto trading and allied activities. In March 2020, the Supreme Court quashed the order as unconstitutional. Ever since there has been no look back to the industry.

The government came up with a draft bill this March that proposed a blanket ban. However, the government began to rethink and is now considering adopting a liberal approach.

The Advertising Standards Council of India (ASCI) is reportedly examining ads run by crypto exchanges in India and may soon issue guidelines.

In July, a Public Interest Litigation was filed before Delhi High Court against crypto exchanges WazirX, Coinswitch Kuber, and CoinDCX, seeking the court’s directions to SEBI, India’s securities markets regulator to issue guidelines on advertisements. The next date of hearing is in December.

The long-awaited law to regulate cryptocurrencies is expected to be introduced in Parliament during the upcoming budget session in February 2022. SEBI, the securities market regulator had recently warned investment advisers from dealing with unregulated products.

Opposition leaders raise concern on lack of crypto regulations

The raining crypto ads caught the eyes of opposition leaders who in recent times raised concerns over the unregulated industry.

“Just an observation, so many ads in print, on tv, online space for crypto investment and yet no guidelines or regulations in place for their functioning. Important for investors to know that the GoI hasn’t bothered to bring clarity&for these companies to educate investors about it,” Shiv Sena MP Priyanka Chaturvedi tweeted a few days back.

Congress leader and former South Mumbai MP said if unregulated, the cryptos can disrupt India’s monetary and financial stability.

According to recent crypto study, 105 million Indians or a staggering 7.9% of India’s population own cryptocurrency.

— Milind Deora | मिलिंद देवरा ☮️ (@milinddeora) November 1, 2021

Decentralised finance is the future of money. But if unregulated by @RBI, cryptos can disrupt India’s monetary & financial stability & harm investors’ interests.

Another Congress leader and former Karnataka minister for IT, Priyank Kharge said the indecision of the government will be disastrous to many. He questioned whether the ads are even legal?

Cryptocurrency is a regulatory grey area in India. Govt’s indecision on it will be disastrous to many.

— Priyank Kharge / ಪ್ರಿಯಾಂಕ್ ಖರ್ಗೆ (@PriyankKharge) November 5, 2021

More than $7 Bn has been invested by Indians & is increasing. TV is flooded by ads that say it is a safe investment. Are these ads even legal?

Govt needs clarity on crypto.

What is way ahead of the crypto industry?

Aggressive advertising without regard to the interests of retail investors can bring the wrath of the government – we have seen this in the gaming sector where several states have enacted laws banning even the games of skill.

Transparency – The crypto industry must convey the risks associated with crypto investments. Every investment product has its own drawbacks and crypto is no exception. Ensure all ads carry a standard disclaimer on the associated risks.

Informed decision – Enable the investors to make an informed decision instead of trying to cash in on the FOMO sentiment.